May 30, 2024

Posting this a few days delayed from when it was available to subscribers at my new venture - Wall Street Beats. That’s why I sort of stopped writing on here for awhile as we were ramping it up and now it’s been launched for a month. If you are interested in actionable insights and trade ideas on these markets come on over. There is a daily broadcast, an interactive chat with all the pros, and research posted regularly. Link is below.

(www.wallstreetbeats.com)

Sometimes you just have to channel your inner Leonidas & make a stand against the mania like he did vs the Persians in the Battle of Thermopylae.

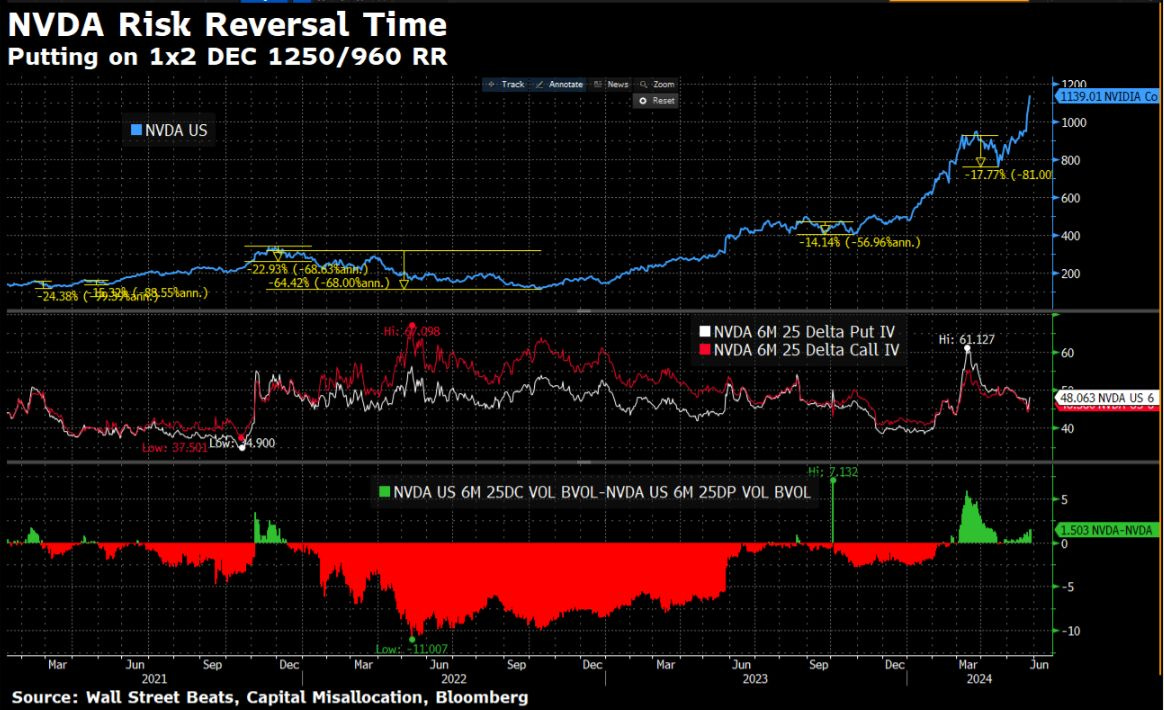

NVDA still sports a positive 6m skew (25dc - 25dp) even after today. We have seen this type of shenanigans 5x since Q1'21 and 100% of the time there was a 14-24% drawdown that ensued with the one '22 66% drawdown. Without discussing more understand that sometimes you just have to buy Chinese stocks in January '24, energy in 2020, FCX in March '20, NVDA in fall '22, META in fall '22, and now double shorting NVDA in May '24. The edges are where the most explosive returns on a time-adjusted basis can be realized.

Now for the actual write up.

The Case for Putting on a 1x2 NVDA DEC ‘24 1250/960 Bearish Risk Reversal

The Setup

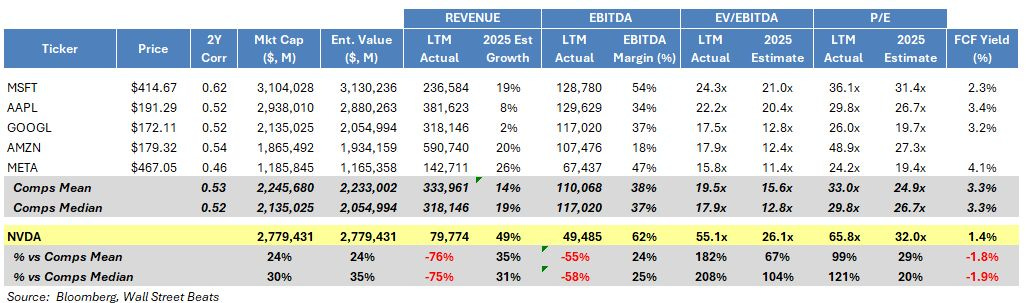

Last Wednesday NVDA reported a strong earnings report and guide which then propelled the stock up over 20% ever since continuing its unabated march to pulling the full “Cisco circa 2000” run to becomning the largest market cap company in the S&P 500. NVDA now sports a $2.8 trillion market capitalization leaving it within breathing distance of less than 10% of overtaking both Microsoft and Apple to become the new official king of the S&P 500. The only thing is that NVDA has 62% less EBITDA than the two kings and 66% & 79% less revenue respectively. There is alot of market cap and hopes riding on the growth assumptions for the coming quarters.

In addition to being worth almost as much as MSFT & AAPL, NVDA’s market cap exceeds the entire US energy sector, as well as the entire German stock market, and its market cap is now 10% of US GDP. These sort of sanity tests have historically served me well in stepping back to observe a mania in progress.

For way of reference, in March 2000 CSCO overtook MSFT to become the largest company in the S&P 500 with a 4.4% index weight vs NVDA's 6% weight today. Back then the Top 10 stocks comprised 27% of the index vs 31% today. History might not repeat but it often rhymes and this may be one of those times.

The report was good enough to clear out bearish positioning and sent the stock up to $1150 per share which is 55x TTM EBITDA, 66x TTM EPS, and a very thin 1.4% FCF Yield. But the growth is incredible! This is true the company is expected to keep growing at a blistering pace making 2025 EV/EBITDA & P/E 26x and 32x respectively. But I learned at a very early age that buying crowded growth stories that have run for awhile tends to carry large drawdowns along the way. I believe now is one of the times you can catch the market offsides.

What is more interesting to me is the fact that a positive skew in NVDA options has emerged measured by subtracting the implied volatility of the 6m 25 delta puts from the 6m 25 delta calls. As you can see below there are have been about five occasions where this has occurred since 2021. Each time it occurred there were drawdowns of -24%, -15%, -66%, -14%, & -18% (sequential) subsequent to the appearance of this positive vol skew. It is possible we see it climb a little more but given that the stock is now 10% of US GDP and essentially the same size as the two biggest baddest tech companies in the world I feel as though its asymmetric to the downside in the near term and medium term.

The Trade

On Tuesday right before the close I sold the Dec. 2024 1250 strike Calls for $130 and used the proceeds to fund 2× 960 Puts leaving me with a $2.60 credit, which is +22bps if NVDA closes between 960 and 1250 at expiration. This allows you to take advantage of the vol skew and put on what I view as a very asymmetric near term setup for price action as I believe its sitting on air post the earnings report up at these levels.

I put this on as a bearish speculative bet which I would only recommend for those skilled in trading options and who have a good understanding of the dynamics present with delta and gamma dynamics in relation to spot and implied volatility moves.

But what is more interesting for a larger set of the readers is that this can be put on for those of you long and not really wanting to sell and pay ST cap gains tax. This trade allows you to participate for another 10% of the upside to $1252.50 and caps your downside from $1140 spot price at the time of writing to about -15% to $962.50. The interesting thing is that you start making money if it keeps dropping. So in essence you are locking in gains of prices present before earnings and actually can make money if it has a retest to the 150dma of around $700 or the 300dma at around $600.

The Rational

Last quarter’s Earnings are behind us & positioning unwinds have taken the stock to absurd levels. This is the time to put this on right here given the right tail options skew present.

I am personally skeptical of LLM’s value add and think the narrative is about to shift as these models have yet to produce any real revenue models that can support the expectations embedded in the stock market. The absurd Google AI search launch is yet another reminder that these models haven’t shown any real intelligence are likely still garbage in garbage out. The META AI Chief penned an article in the FT this weekend saying LLM technology isn’t the path to AGI & we are still 10 Years off.

AMZN has said it’s holding off until the next gen chip arrives & there are datapoints that show the secondary market has softened. This is still just a cyclical chips company, albeit more of a platform than a traditional semis company trading at 66x TTM P/E multiple with peak growth expectations.

RSI daily and weekly is above 80 & next Qtr we lap the large Q2’24 EPS jump meaning major earnings deceleration coming. A retest to $900 / $700 / $600 all seem plausible and possible, especially if the market turns over as I expect it to as we move closer to a recession.

This is a crowded max complacency trade that offers downside convexity and beta to the LLM narrative changing, risk assets rolling over, and a crowded trade unwinding. Even if you are long it’s probably a great overlay.

Competition is coming and its hard to see NVDA really continue to dominate beyond the next 4 quarters. My partner at WSB Russell Young has been a large NVDA bull and been very right. He assures me that NVDA is so far in front that these guys can’t catch them but I am skeptical and historically view competition as the “margin killer”. Given that NVDA is running 62% EBITDA margins and expected to see its top line grow by 50% by 2025 I view the chart below as something that should warrant caution.

Giddy Up - It's Line in the Sand Time

Risks:

Market continues to defy gravity and NVDA continues to trade well despite a large portion of the market internals turning sour

NVDA crushes numbers again taking the stock even higher - but this is mostly just a risk if you run this trade naked

The call skew widens driving the value of the calls up relative to the puts creating extra PnL risk during the time til expiration